As advances in payment are changing the way consumers transact and new job structures are altering the economic reality of many of America’s workers, the need for faster and incidental wage payment surges.

Enter Earned Wage Access, the ideal solution for today’s employee, employer, and payroll provider. But what is earned wage access, exactly?

In short, earned wage access (EWA) allows employees to access a portion of their earned wages before the next payday. Also known as on-demand pay, EWA is not just another payment trend – it is fast becoming a mainstream tool in payroll.

To understand why, we uncover the factors fueling the demand for early pay and answer the question “What is earned wage access?” in more detail, breaking down its benefits and cons for employers and workers.

We cover how EWA works, how it integrates with payroll processes, and how payroll providers can implement EWA programs to improve their clients’ workforce retention and open up new revenue opportunities.

Read on to learn more about earned wage access.

Bring early pay to your payroll process. Get in touch with Berkeley Payment and find out how to seamlessly offer earned wage access to your clients.

What is earned wage access and why is it so popular?

We briefly defined earlier that earned wage access is an employee benefit that allows employees to access a portion of their earned wages before the scheduled payday.

The financial service of early wage access started to gain traction in the early 2010s with the rise of gig and hourly workers. More EWA providers emerged during the COVID-19 pandemic, researchers noted in a 2023 Harvard paper on EWA.

With many independent gig or hourly workers earning a low wage, it comes as no surprise that most early wage access users make less than $50,000 annually, according to data from four EWA providers collected by the U.S. Government Accountability Office.

As did the pandemic, the current cost-of-living crisis is driving demand for early pay solutions for these types of workers, who often struggle to make ends meet.

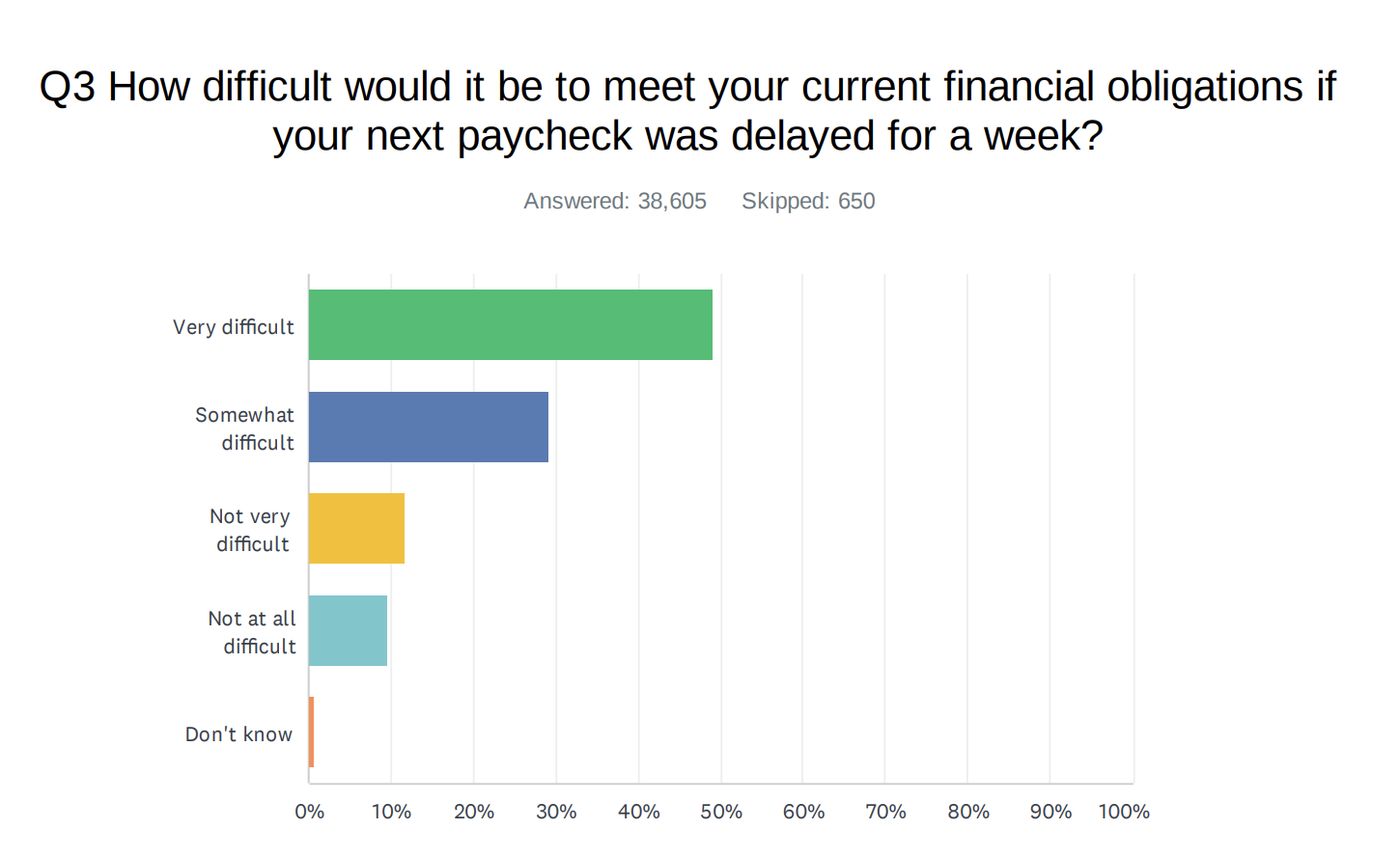

As of last year, close to four-fifths (78%) of Americans find it somewhat to very difficult to meet their financial obligations if their paycheck were delayed by only one week, a 2023 survey conducted by payroll network PayrollOrg revealed. That’s a 6% increase over the previous year.

Source: PayrollOrg

Another alarming indicator of the precarious financial situation many employees find themselves in between paydays, only about half (49%) of Americans spend less than their incomes, another 2023 survey found.

This is the lowest percentage the particular survey has registered since its conception in 2018 by Financial Health Network, a network of business leaders and policymakers committed to the financial well-being of employees and consumers, reflecting the growing popularity of – or what could better be called a need for – wage access services.

Over three-quarters (76%) of American workers across all age groups say it is important for their employer to offer EWA, HR service company ADP found in a 2022 study.

The benefits and cons of earned wage access

With so many Americans having little to no financial leeway between paychecks, offering earned wage access programs seems like a sure way to improve financial wellness.

Through EWA programs, workers on an employer’s payroll have less financial stress, can avoid overdraft fees, and don’t have to rely on credit with high-interest rates or predatory payday loans to cover unexpected expenses or bridge their pay cycle.

This benefits employers, too, with 89% of employees interviewed in the aforementioned ADP study reported feeling more motivated and productive at work when they had access to their pay on their schedule.

Employers surveyed in the study reported that EWA helped them retain and attract talent.

Source: ADP

Similarly, a 2022 Harvard Business School study found that employees using a Mexican EWA company, Minu, were 12% less likely to leave their company in the next pay cycle.

Yousif Mohammed, Global ESG Lead and EMEA Head of Trends & Advisory at J.P. Morgan, also notes that “Earned wage access is a win-win for employees and employers.” In a J.P. Morgan report on EWA, Mohammed mentions how “For employers, it offers a competitive benefit to help retain employees amid a tight labor market, while employees receive access to a flexible and sustainable tool to managing their finances.”

However, EWA services are no cash flow cure-all for workers struggling to make it to their next paycheck or wanting to cover emergency expenses. As with other financial services, on-demand pay comes with cons.

The most obvious pitfall might be workers’ dependency on EWA as they come to rely on early pay to cover stacking financial burdens, potentially locking them into low-paying jobs with little hope of climbing up the economic ladder.

EWA programs may also involve various fees that both employees and employers should be aware of, such as membership and transfer fees, which can impact the amount of money they receive.

With various earned wage access providers operating in North America, these transaction fees can vary wildly – with some equaling the late fees of traditional lenders.

These “faux EWA” products are simply payday loans dressed up in "fintech" marketing, the nonprofit Center for Responsible Lending (CRL) warns.

And while true EWA programs can benefit low-wage workers when properly designed, they can also harm consumers when products are allowed into the marketplace without proper guardrails and regulations.

State regulations on earned wage access

States are recommended to regulate all EWA products as credit and require compliance with consumer protections to prevent the predatory lending debt traps commonly associated with payday loans, CRL writes.

After Missouri and Nevada first signed bills advocating for legislation and guardrails for EWA providers, Arizona, Kentucky, and Hawaii have become the latest states to regulate earned wage access (EWA) products and services.

These bills, proposed in early 2024, aim to define EWA services, establish licensing requirements for EWA providers, and set guidelines for mandatory disclosures and annual reporting, law firm Troutman Pepper writes.

With other states likely following suit with varying regulations, employers and payroll providers should thus be informed of the latest state regulations regarding EWA services.

How payroll providers can benefit from earned wage access

To underline the benefits and cons for payroll providers integrating EWA services into their payroll system, let’s recap the pros and cons of EWA for employees and employers.

In summary, the benefits and cons of EWA programs for employees include:

- Improved financial flexibility

- Enhanced job satisfaction and retention

- Reduced financial stress

- Alternative to high-cost credit

- Dependency risk

- Potential fees

For employers, EWA benefits and cons include:

- Increased employee motivation and productivity

- Increased retention of employees

- Easier talent attraction

- Legal and compliance

- Cost and fees

Looking at the above, the pros for payroll providers are obvious – generating more value for them and their clients.

The potential cons are fees and regulations, though picking the right EWA service and knowing how earned wage access works in the payroll process can mitigate these risks and significantly reduce costs.

How does earned wage access work?

When the right EWA program is implemented well it benefits all parties involved. But how does earned wage access work and how can a payroll provider best integrate it into their payroll system?

EWA services can be split between two business models.

In the employer or payroll-integrated model, on-demand pay providers work with employers and payroll processors to provide employees with earned wages.

In this model, the EWA provider has access to timesheet and payroll data to confirm hours worked and wages earned, and determine early wage access. The employer advances payment to its employees through the EWA provider, ahead of a regular pay date and either by direct deposit on their bank account or through a prepaid card for employees.

Employers can cap the advances per pay period, which are repaid by the employee to the employer through deductions from the employee’s next paycheck.

Fees associated with payroll-integrated EWA services vary and, if there are any, can be covered by either If there are fees for the service, the employer, the employee, or both.

In the direct-to-consumer (D2C) model, consumers can benefit from instant pay by subscribing directly to an EWA provider that monitors their cash flow and paydays to determine earned wages.

In this model, consumers can request an advance from the EWA provider and then repay the provider most commonly through an automatic deduction from their next paycheck. Consumers are typically charged either a monthly subscription fee, a transaction fee, a voluntary fee amount, or a hybrid of all three. A credit score is typically needed.

D2C models are closer to traditional credit and employees should be aware of faux EWA schemes.

That said, how does the payroll-integrated model fit into the traditional payroll process?

How does EWA fit into the payroll process?

EWA does not typically impact payroll processes, enabling a seamless transfer of funds to employees who request early access to their earned wage.

Elena Whisler, senior vice president at payments company The Clearing House, argues that implementing EWA in payroll processes is far less complicated than one might think.

“One misconception HR leaders may have about EWA is the potential to complicate the traditional payroll system”, Whistler said. “The good news is that EWA does not impact the withholdings process—including tax and other deductions—that payroll providers use with their customers (the employer), as EWA is most commonly provided directly to the employee, and the employer’s payroll cycle isn’t disrupted.”

She further clarified that “For the employer, the previously accessed earned wages are treated as a deduction from the employee’s paycheck.”

Conclusion

As we've covered, earned wage access allows early access to earned pay, bridging financial gaps responsibly.

With demand surging among employers and employees alike, seamlessly integrating EWA services can give payroll providers a competitive edge. By choosing the right partners, automating confirmations and transfers, and capping limits, payroll providers can enable EWA’s benefits while avoiding risks like fees and regulatory issues.

And the big takeaway?

Getting ahead of the curve on EWA enablement means retaining and attracting more clients, tapping new revenue streams, and boosting value.

Both employers and employees want earned wage access. Can you provide it? Connect with Berkeley Payment and learn how to integrate reliable and customizable EWA tools with your payroll system.